Not the prettiest game ever, but a good win. In case you're interested. Highlights Channel 4 at 11:25 tonight

I was going to look it up as I don't have sky, so thanks for helping with this! Enjoy your curry mate

Not the prettiest game ever, but a good win. In case you're interested. Highlights Channel 4 at 11:25 tonight

Only a foxy lady can jump off a ball like that.

Reminds me of Putin, riding a weasel, riding a woodpecker.

To me there seems to be a bit of 'brokeback mountain' about putins press pics...always with a shirt off... and always so pale. weak genes.

The cats are very big in RussiaTo me there seems to be a bit of 'brokeback mountain' about putins press pics...

...I think he might be trying to hide something.

View attachment 252154

View attachment 252155

View attachment 252156

Sorry, mate. It's finished now and heres a cat to make up for it:Can we not turn this into a thread of Putin pictures? Some of us have to try and sleep soon...

Sorry, mate. It's finished now and heres a cat to make up for it:

View attachment 252158

I'm getting a bit concerned about the quantity of putin pics I've got in my "special folder".

it depends where it is - the average house price in the Sydney area is still about 1 million AUD - but when you look at Manly for example, 1.5-3.5 million for a "normal" house is not unusual there. Currently a bubble is developing, because people fear, if they don't buy now, they might never be able to - and this creates an increase in house prices beyond any sense. One can still make quite some money in the housing market, but not with overpriced properties - well, true luxury houses will always be a good investment, because good locations for those are mostly sold out already. The market for average houses will collapse at some point in time, especially if people are now taking mortgages without down payments - which makes them very vulnerable to any increase in interest rates.

This gives me a terrifying idea...

it depends where it is - the average house price in the Sydney area is still about 1 million AUD - but when you look at Manly for example, 1.5-3.5 million for a "normal" house is not unusual there. Currently a bubble is developing, because people fear, if they don't buy now, they might never be able to - and this creates an increase in house prices beyond any sense. One can still make quite some money in the housing market, but not with overpriced properties - well, true luxury houses will always be a good investment, because good locations for those are mostly sold out already. The market for average houses will collapse at some point in time, especially if people are now taking mortgages without down payments - which makes them very vulnerable to any increase in interest rates.

but overall you are right - people have to downgrade their expectations currently because the market is overheated and driven by fear never to be able to buy a house. but this is not just in Australia this way, USA and Canada show the same symptoms as well as some countries in Europe.

well, Canada has now introduced a "stress-test" - someone applying for a mortgage must be able to qualify for an interest rate 2% higher than what he could get, but at least 5.25% - so this will most likely end the development of the housing bubble there, because this stress test decreases the buying power of people quite a bit.

Yep market has gone a bit mad in uk - i got my house early last year and its gone mad - houses are coming and going round my area. I cant understand it. Where’s all the money coming from. Luckily I’m an old folk and I downsized. But wow, bonkers. It’ll burst you see.It's mad here where I am in the UK - central south coast - an awful lot of old folks here and boomers have inflated the market. I have no hope of getting a mortgage for a property here as a single guy, it's crazy

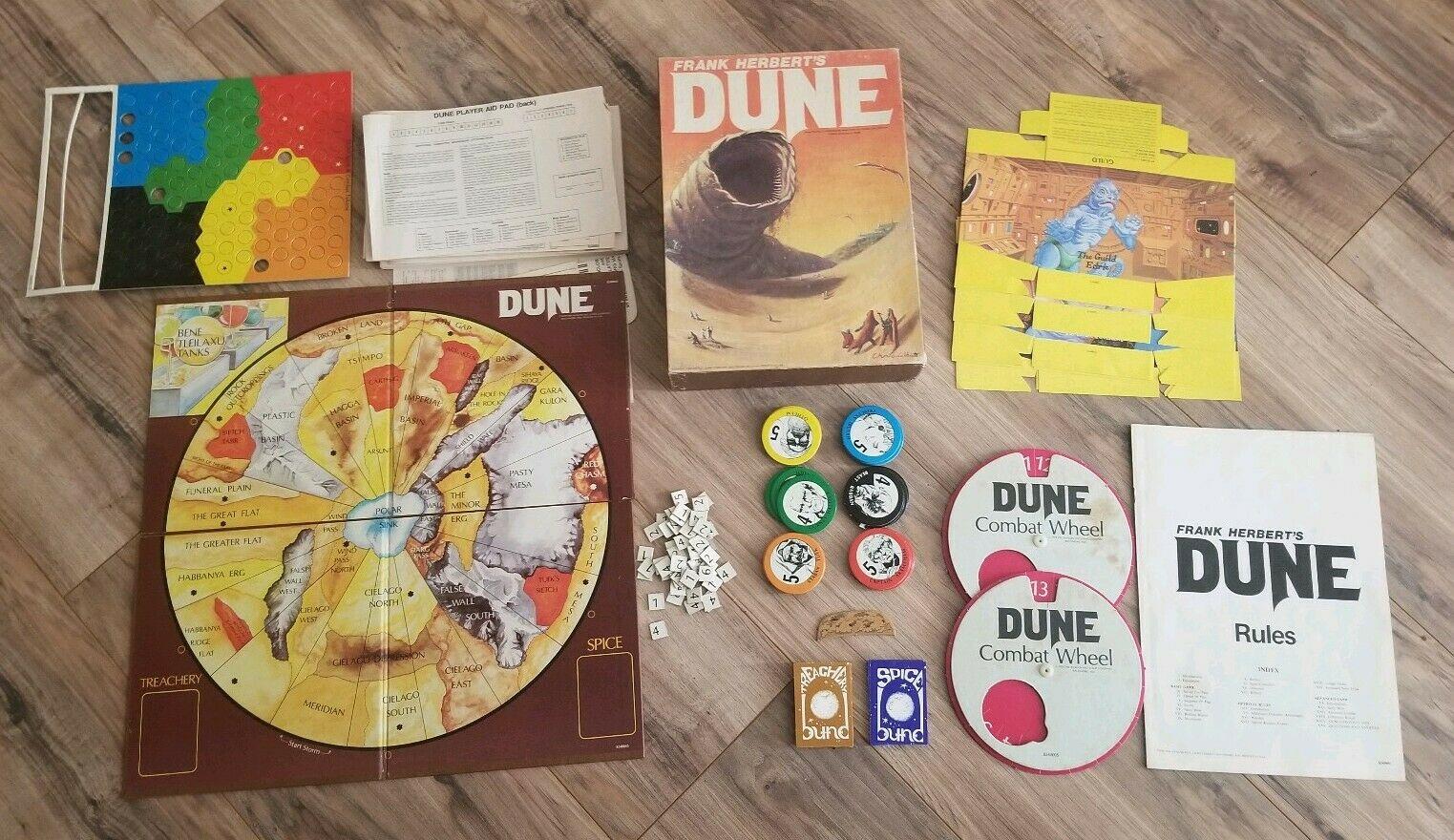

Played that quite a bit, pretty good game. Also played Panzerblitz. And Third Reich, Russian Campaign, Squad Leader, Advanced Squad Leader....Board game. One I bought a (massive) board game called Panzerblitz https://en.wikipedia.org/wiki/PanzerBlitz from Avalon Hill at a school fete, and, reading through the catalogue inside wanted this: