You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Game Discussions Star Citizen Discussion Thread v12

- Thread starter Yaffle

- Start date

-

- Tags

- star citizen

Hang on a minute...isn't that Trump's reciprocal tarrifs board?

Last edited:

Oh right yep. Yeah the 2014 poll was much more tepid:

55% - Yes

26% - No

20% - No preference

The classic 'do more, but faster' 2013 vote was stacked heavily in favour though:

5% - Take the funds raised counter down after $23 million (mission achieved!)

7% - Have the funding counter display the amount towards the current stretch goal / feature, not the total amount once we reach $23M.

88% - Keep it up through development and continue to offer stretch goal rewards in addition to extra features and development milestones.

If from only a sliver of the community etc.

Shock, in poll, players want devs to do more faster, now here is Carl with the weather.

Hang on a minute...isn't that Trump's reciprocal tarrifs board?

Nah, it wasn't generated with ChatGPT.

I'm sorry, Trish, the weather is currently being refactored. Back to you.Shock, in poll, players want devs to do more faster, now here is Carl with the weather.

It probably did. But those only work if they can sell it and they have their own figures on how good sales have been for the last few years.Weird - I always assumed Citcon paid for itself.

Let's find out...

Financials are up

---

EDIT:

First thing that jumps out...

TLDR:

Costs up 57%

Net loss of £8.4m (vs net gain of £8.3m in 2022)

All of this just for UK, so potentially doubled for global operations. Does include the Turb acquisition as a one-off cost.

---

TLDRTTLDR:

Those statues don't come cheap

Financials are up

---

EDIT:

First thing that jumps out...

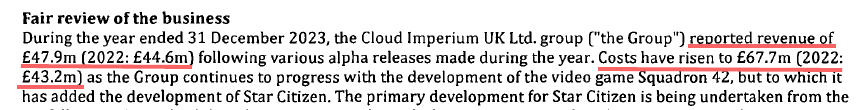

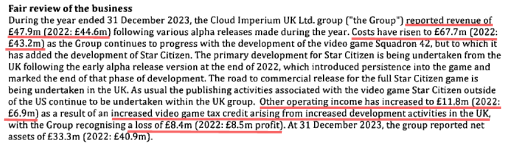

Reported revenue:

2023: £47.9m

2022: £44.6m

Other operating income (tax credits etc)

2023: £11.8m

2022: £6.9m

Costs:

2023: £67.7m

2022: £43.2m

Net:

2023: (£8.4m) [loss]

2022: £8.3m

Reported revenue change:

7%

Other operating income change:

58%

Costs change:

57%

Net change:

-200%

2023: £47.9m

2022: £44.6m

Other operating income (tax credits etc)

2023: £11.8m

2022: £6.9m

Costs:

2023: £67.7m

2022: £43.2m

Net:

2023: (£8.4m) [loss]

2022: £8.3m

Reported revenue change:

7%

Other operating income change:

58%

Costs change:

57%

Net change:

-200%

TLDR:

Costs up 57%

Net loss of £8.4m (vs net gain of £8.3m in 2022)

All of this just for UK, so potentially doubled for global operations. Does include the Turb acquisition as a one-off cost.

---

TLDRTTLDR:

Those statues don't come cheap

Attachments

Last edited:

Some fun ones dug up by guys deeper into the honey pot

An existing shareholder has loaned them £10m. Payable Dec 31st 2027:

(So whoever it was nabbed those Q1 shares got them as a freebie and gave CIG the $10m loan in return?)

The Calder's have a new put option for 2027. Now pegged to 'within 30 days of the financial statements being delivered' instead of 'Q1'

(IE the FY2025 accounts are supposed to drop Dec 31st 2027 etc. The other minority holder seems to have had their put option brought forward from 2028 to 2027 as well?)

The auditors have a £5m cap on liabilities for this audit.

(Pretty sure this is new)

The Qualified Opinion is back...

The auditors fear shenanigans...

(PwC actually included this last year too but we missed it. Possibly relates to the tracker? Or even CIG's financials blog itself?)

An existing shareholder has loaned them £10m. Payable Dec 31st 2027:

(So whoever it was nabbed those Q1 shares got them as a freebie and gave CIG the $10m loan in return?)

The Calder's have a new put option for 2027. Now pegged to 'within 30 days of the financial statements being delivered' instead of 'Q1'

(IE the FY2025 accounts are supposed to drop Dec 31st 2027 etc. The other minority holder seems to have had their put option brought forward from 2028 to 2027 as well?)

The auditors have a £5m cap on liabilities for this audit.

(Pretty sure this is new)

The Qualified Opinion is back...

The auditors fear shenanigans...

(PwC actually included this last year too but we missed it. Possibly relates to the tracker? Or even CIG's financials blog itself?)

Last edited:

And that was years ago. Still don't how this this successful project needs loans.

And that was years ago. Still don't how this this successful project needs loans.

The loan bit at least seems to be recent. If I'm understanding the 'On 03 March 2025, the group has drawn down £10 million under a loan facility'.bit right anyway. (Although I don't understand why it'd be in the 2023 accounts, unless it was tied to required shareholder declarations etc. Also I don't understand accountancy

The Calder's have a new put option for 2027. Now pegged to 'within 30 days of the financial statements being delivered' instead of 'Q1'

The sentence ends unexpectedly.

For 1,599,900 shares their first put rights are exercisable ...

(2027 and 2030) and for all 1,877,400 shares.

What for all?

Infatrade's option was in Q1 2028 and now 31 Dec 2027.The other minority holder seems to have had their put option brought forward from 2028 to 2027 as well?)

tbf, that reads like boilerplate to me. The auditors must evaluate where the directors could cheat if they were to cheat.The auditors fear shenanigans...

The "resolution dated 29 July 2024" was not filed with Companies House.The auditors have a £5m cap on liabilities for this audit.

Last edited:

It seems they've got a £10m liability to return their offices to their original state on termination of the lease...

(Reckon they'll just stick a Vanduul behind the coffee counter and run)

That's it - they're really in trouble!

It's not clear whether the existing shareholders are one and the same or not. In January, they sold shares for 5 million, then loaned another 10 million in March.(So whoever it was nabbed those Q1 shares got them as a freebie and gave CIG the $10m loan in return?)

Could be because of the "directors are confident funds won't run dry for at least 12 months from the date of approval of the statements" bit.Although I don't understand why it'd be in the 2023 accounts, unless it was tied to required shareholder declarations etc. Also I don't understand accountancy

A new company name. Turbulent France, Lyon. Dissolved in April 2024.

https://annonces-legales.lefigaro.fr/annonces-legales/turbulent-france-dissolution/

Last edited:

Best year of funding in 2024 but they still needed a 10m loan in 2025... that's quite interesting.

Let's go over to Spectrum and see their response to the financial report...

robertsspaceindustries.com

robertsspaceindustries.com

Ah, main take so far, nothing to worry about, all good. No mention of taking a loan at all. Little engagement so far.

Next thread...

Ah, no other thread discussing the released report. Its almost like they don't care about the financials. One would think they might be considering that they need money to deliver the game.

There is this thread asking about them before it went live:

robertsspaceindustries.com

robertsspaceindustries.com

And this response:

Why should someone be entitled to demand a late financial report from a company you helped build with your money, that has spent the last 13 years failing to deliver on what was sold? Hmm... i can't imagine.

Of course, it got shut down by Nightrider... i expect the other thread will go the same way once people start bringing up uncomfortable points.

Let's go over to Spectrum and see their response to the financial report...

UK Group Summary Accounts 2023 - Star Citizen Spectrum

For your perusal. Expect the blog update any day now....

Ah, main take so far, nothing to worry about, all good. No mention of taking a loan at all. Little engagement so far.

Next thread...

Ah, no other thread discussing the released report. Its almost like they don't care about the financials. One would think they might be considering that they need money to deliver the game.

There is this thread asking about them before it went live:

Financials for 2023 when? - Star Citizen Spectrum

It has been 15 months since the financials for 2022 were published. When can we expect the financials for 2023, much less 2024? With the closure of the LA studio and ending in person citizencon...

And this response:

pfffft.... some people really have an ego problem... why should u been entitled to demand an financial report from a game stuido? some people really think of themselfs as too important as it seems. (no thats no sarcasm here. some "gamers" or also called "customers" should relax and mind their blood pressure)

Why should someone be entitled to demand a late financial report from a company you helped build with your money, that has spent the last 13 years failing to deliver on what was sold? Hmm... i can't imagine.

Of course, it got shut down by Nightrider... i expect the other thread will go the same way once people start bringing up uncomfortable points.

As this thread has veered into hyperbolic assertions being presented as facts or legal conclusions, none of which are appropriate or suitable to speculate on or discuss on Spectrum, this thread is now closed.

Some interesting bits and piece in the GuardFreq hot take:

Source: https://www.twitch.tv/videos/2424282884?t=00h33m35s

- Tony ponders whether CR is the source for the loan. (Having taken out a loan on his own assets). He doesn't see the Calders / Turbulent / Infatrade as likely candidates.

- The Turb guys got 2 mil each up front in the buyout, and then £0.5m a year for a few years up to mid 2025. They took 'cash now' as their payback. (Which is sensible

. But doesn't speak to huge confidence in the project.)

Last edited:

This is interesting. Looks like salaries doubled between 2022 and 2023. Wow.

- Tony ponders whether CR is the source for the loan. (Having taken out a loan on his own assets). He doesn't see the Calders / Turbulent / Infatrade as likely candidates.

He makes the point there should be a shareholder report about the shares. Its a good point, CIG delaying it? Are they allowed to delay it?

This is interesting. Looks like salaries doubled between 2022 and 2023. Wow.

Retention & turnover problem. They were losing critical people too fast.

Also, how much of that is in company shares?